-

1300 994 890Property Management1300 832 373Consulting & Certification

Converting an Existing House to Specialist Disability Accommodation

Also, check out our page.

How to Design, Develop and Build Specialist Disability Accommodation

What needs to be considered when refurbishing an existing dwelling?

Each week, we receive a number of calls from people looking to convert an existing 1a house into Specialist Disability Accommodation (SDA). Whilst this is possible, it is generally not a cost-effective exercise.

The Pricing Arrangements for Specialist Disability Accommodation 2021-22 states for New Build is as follows:

A dwelling is a New Build if it meets all of the following five conditions:

1). either:

a) it was issued its first certificate of occupancy (or equivalent) on or after 1 April 2016; or

b) it has been renovated or refurbished and issued with a certificate of occupancy (or equivalent) after 1 April 2016, and:

i) because of the renovation or refurbishment, the dwelling meets the Minimum Requirements for a Design Category other than Basic design set out at Step 2B below; and

ii) the cost of the refurbishment is equal to or greater than the amount set out in Appendix F – Minimum Refurbishment Costs for New Builds (2021-22); and

2). either:

a) it is enrolled to house five or fewer long-term residents (excluding support staff); or

b) it is the home of a participant who intends to provide SDA to themselves (as a registered provider) and to reside there with the participant’s spouse or de facto partner and children; and

3) all its shared areas, and any bedrooms for use by SDA-eligible participants comply with the Minimum Requirements for a Design Category other than Basic design set out at Step 2B below;

4) it does not breach the density restrictions for New Builds in s 31 of the SDA Rules. The density restrictions apply when there are multiple dwellings on a single parcel of land; and

5) fewer than 20 years have elapsed from the date the certificate of occupancy (or equivalent) in paragraph 1 of the Definition of New Build above was issued. When 20 years have elapsed from the date of the certificate of occupancy (or equivalent) the enrolment will convert to Existing Stock.

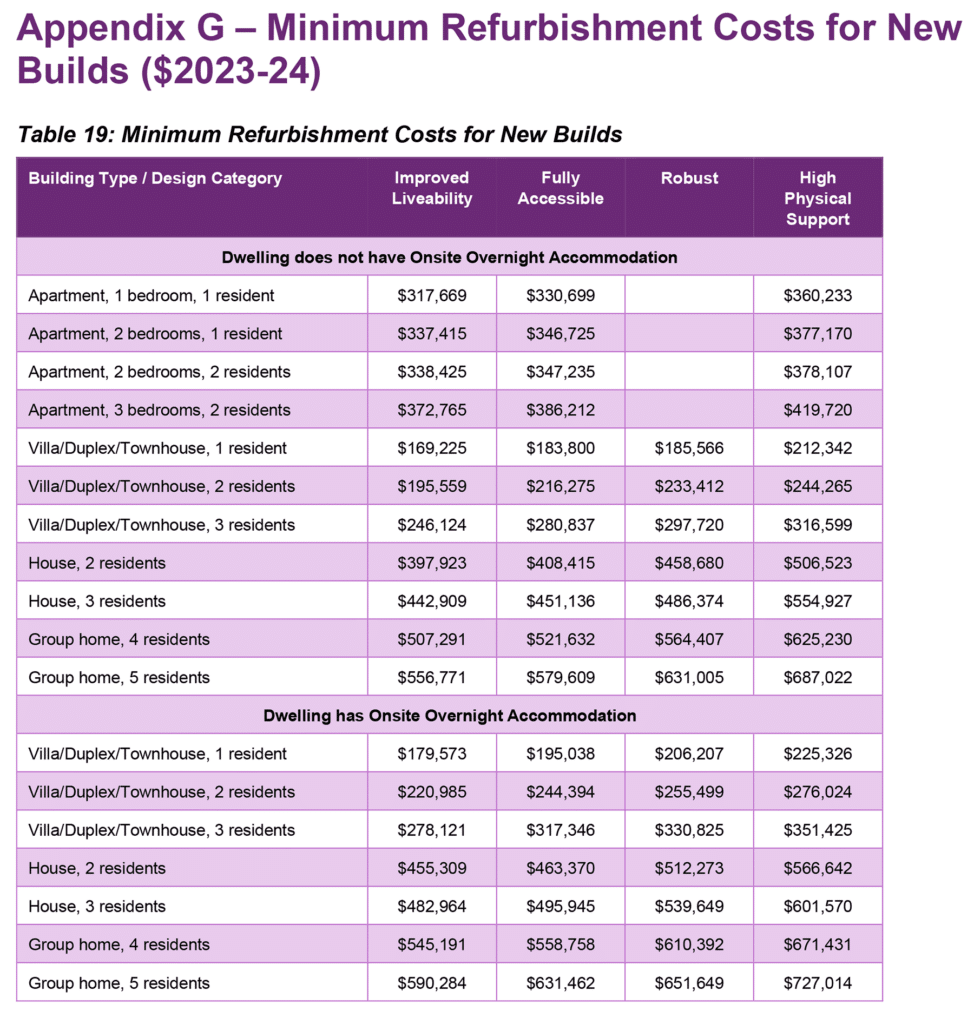

Appendix F – Minimum Refurbishment Costs for New Builds

The following is the extract from the Pricing Arrangements for Specialist Disability Accommodation 2021-22

In Simple English

Developers/ investors have two options when purchasing a property: convert into SDA and achieve compliance.

Option 1A

To be considered a new build, you can own or purchase a dwelling issued with its first certificate of occupancy (or equivalent) for use as SDA on or after 1 April 2016. In most cases, for the first few years after 2016, the dwelling may have been designed to the old SDA standards that included Liveable Housing Guidelines (LHA).

NOTE the critical condition of the “first certificate of occupancy” for the dwelling. If its first certificate of occupancy was issued for a non-SDA dwelling, then this option is not applicable.

Option 1B

For a refurbishment or renovation of an existing dwelling (that already has a certificate of occupancy for non-SDA use) to be considered a new build, the dwelling must be issued with a certificate of occupancy (or equivalent) after 1 April 2016, and the refurbishment to the dwelling must:

- Meet the Minimum Requirements for the Selected Design Category.

- The cost to refurbish or renovate the home must be detailed in Appendix F – Minimum Refurbishment Costs for New Builds.

Therefore, the total investment must include the Purchase price of the house and land + Minimum Refurbishment Cost.

Option 2

For existing supported accommodation to be considered a new build, the following requirements must be met.

The SDA is already enrolled in housing five or fewer long-term residents (excluding support staff), or it is the home of a participant who intends to provide SDA to themselves (as a registered provider) and to reside there with the participant’s spouse or de facto partner and children.

All its shared areas and any bedrooms for use by SDA-eligible participants comply with the Minimum Requirements for a Design Category and fewer than 20 years have elapsed from the date the certificate of occupancy (or equivalent) was issued. When 20 years have elapsed from the date of the certificate of occupancy (or equivalent), the enrolment will convert to Existing Stock.

Additionally, the SDA must not breach the density restrictions for New Builds in s 31 of the SDA Rules.

When these figures are added to the original purchase price of the home and land, typically, the development of the SDA becomes unfeasible. For example, when comparing the cost of a newly built House for 2 Participants +OOA to that of a Minimum Refurbishment Cost for New Builds of $402,295, a developer/ investor must consider whether the investment is worthwhile.

OOA = Onsite Overnight Assistance

NDIS New-Existing-Legacy Calculator

Farah Madon has developed a calculator based on the definitions of ‘new build’, ‘existing stock’ and ‘legacy stock’ under the NDIS SDA Price Guide 2020-21 and NDIS Rules 2020. Select ‘Yes’ or ‘No’ to a set of 11 questions. The type of Dwelling will show as either ‘new build’, ‘existing stock’, ‘legacy stock’ or alternatively show that “Dwelling is not eligible for SDA”.

Access the NDIS New-Existing-Legacy Calculator

NDIA Advice

What can be included within the Minimum Spend

8 March 2024

We have received the following advice from the NDIA

All costs usually associated with a dwelling refurbishment (modification) form the basis of the minimum refurbishment cost requirements as outlined in the SDA Pricing arrangements, previously the SDA Price Guide. The costs are inclusive of planning and development application/approval costs, engineering design certification, construction costs, as well as dwelling design and certification. This includes consultancy costs such as architectural design, engineering design, accessibility design and certifications. The costs include kitchen and/or laundry appliances that would usually be installed with any dwelling to enable occupancy, however other items of furniture are not considered to be included.

Please note, the cost of refurbishment is considered to be the cost of refurbishing the dwelling in one project. For example, if a dwelling had been refurbished over two, time-separated projects, the cost of refurbishment would not be considered as the combined cost of both projects.

Evidence of the renovation/refurbishment costs incurred in the form of a building contract and/or paid invoices is acceptable.

Bruce has over 32 years of experience in disability access, architectural design, documentation & project management

He formed Equal Access Pty Ltd in 2006 in response to growing recognition, that whilst businesses were being urged to respond to their obligations under the Disability Discrimination Act, the majority of assistance available was focused almost entirely upon the needs of the individual with a disability without an understanding of the impacts and practicalities for building owners, managers and consultants.

Bruce also specialises in evacuation procedures and policy for people with a disability and is a member of the Standards Australia development committee FP-017 Emergency Management Planning – Facilities (AS3745)

Categories

Recent Posts

- Creating Accessible and Inclusive Housing: Universal Design in SDA

- Understanding Luminance Contrast and Colour Contrast for SDA

- Disability Fire Safety Forum: Specialist Disability Accommodation

- Converting an Existing House to Specialist Disability Accommodation

- Why Robust SDA is Failing Participants, Carers and Investors